CEO Update Published: 22 July 2022 Senators Portman and Coons give a boost to FTA chances while Transatlantic Investor Confidence remains steady

While I was quietly swimming around the Small Cyclades Islands, the curtain finally came down on the government of Boris Johnson…well, almost. Mr. Johnson will remain in post until the process for electing a new leader of the Conservative Party is completed on Sept 5th who will also become Prime Minister.

The Covid pandemic and subsequent cost of living crisis has been hard on all incumbent governments; approval ratings for the Biden leadership are at historic lows, Scott Morrison has been dumped in Australia and the leaders in Italy, France and Germany have their own tortuous challenges. But in the end, it wasn’t the big policy issues relating to Covid or the economy that did for Mr. Johnson, but a series of entirely avoidable errors of judgment which certainly got up the noses of the UK public and eventually of the parliamentary party.

At BAB we have no horse in the race, but we hope that whoever wins will keep the Transatlantic relationship and the business community near the top of their agenda.

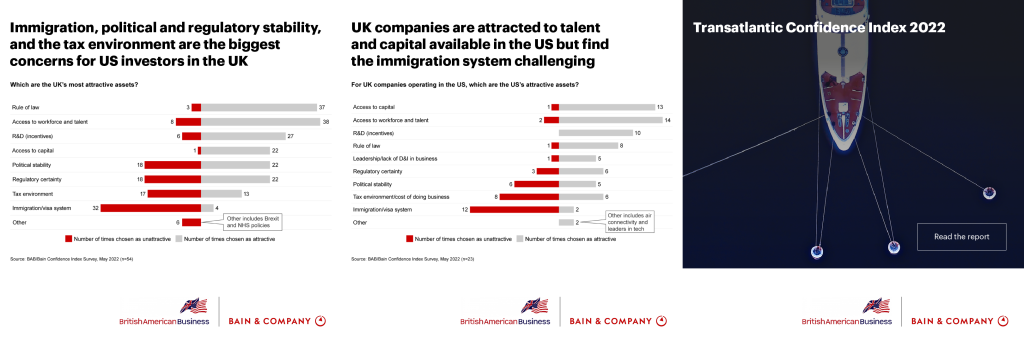

Earlier this week we unveiled the results of our annual Transatlantic Confidence Index survey of US and UK companies. Conducted in partnership with Bain & Company, this survey asks companies how confident they are about the US and UK as places to do business and to invest.

You can see the full report from this survey here, but the summary is that US corporates’ confidence in the UK remains very high, albeit down slightly from last year. Unsurprisingly, UK businesses expressed high levels of confidence in the US as a place to invest although we have no prior year’s data point on which to make a comparison.

Amongst the concerns raised by US companies about the UK are ongoing tensions between the UK and EU, the prospect of future corporate tax increases and a tightening of the labour market. Of course, investment decisions by US firms are made by looking at the relative cases of different markets in the European region and the UK continues to have many long-term advantages.

Our view at BAB is that the post-Brexit trade tensions will reduce over time and that the scarcity of qualified labour is a global problem. We worry about rising corporate tax levels, and would like to see this decision reversed, but for US companies, where corporate tax rates are also likely to rise, the impact on investment location decisions is likely to be small.

The thing that would help the most to boost what is already a strong US UK trade and investment relationship would be a full trade agreement, and, in this context, perhaps the most significant recent development is the Special Relationship Act, unveiled by Senators Portman and Coons at the end of June. The proposed bill would give the administration a five-year window to negotiate a US UK Trade Agreement, essentially a limited extension of the Trade Promotion Authority for a UK deal. As Senator Portman said, “As one of our oldest trading partners, resuming trade talks with the United Kingdom is a no brainer…”

As a participant in the recent US UK Trade and Investment Dialogues, we have heard the US administration’s concerns about globalization and their intention that trade policy should be ‘worker centric’ and green. On both counts an agreement with the UK, where labour and environmental standards are high, would do more to help this ambition, and embed it in an international agreement, than anything else. We hope the new bill gets some traction and that meaningful negotiations can resume but the chances are probably still low.

We continue to be busy in London, New York and Washington on all fronts. We are also helping our Ohio affiliate chapter in the British-American Business Network prepare for its conference in Cleveland on Sept 7 to 9.

The UK Trade Commissioner, Emma Wade-Smith, will be there together with other senior government officials and representatives from British and American companies based in Ohio. You can see the program here and I hope you will consider coming along.

In the meantime, have a wonderful summer!